Richard, Here’s Another Nice Mess You’ve Gotten Us Into

By George H. Friedman*

Chairman of the Board, Arbitration Resolution Services

Introduction

I promised not to discuss politics at the Thanksgiving table, but the holiday meal is over, and I cannot remain silent. As has been widely reported there is, to put it mildly, instability and confusion at the Consumer Financial Protection Bureau (“CFPB”). Here, in a nutshell, is what’s going on:

- Director Cordray announced via a November 15th email to staff that he would be departing the Bureau by the end the month.

- Cordray suddenly announced on November 24th that he was leaving at the end of the day, and as issued a Press Release naming as Deputy Director Chief of Staff Leandra English. Cordray claimed to be acting under authority of Dodd-Frank section 1011(b)(5)(B) (12 U.S. Code § 5491), which provides that the Deputy Director is appointed by the Director and will “serve as acting Director in the absence or unavailability of the Director.”

- President Trump via a November 24th Statement named as Acting CFPB Director the current head of Office of Management and Budget, Mick Mulvaney. The President acted under authority of the Federal Vacancies Reform Act of 1998, 5 U.S. Code § 3345, which authorizes the President to name as Acting Director an individual who has already been confirmed by the Senate as an executive agency officer (the Senate in February confirmed Mr. Mulvaney as OMB Director).

- The Justice Department supported the White House in a November 25th Memorandum to the President’s Counsel.

- Late on Sunday, November 26, Ms. English sued President Trump and Mr. Mulvaney, seeking both an emergency temporary restraining order and declaratory relief recognizing her as the Bureau’s Acting Director. The complaint in English v. Trump and Mulvaney, 1:17-cv-02534, was filed in the U.S. District Court for the District of Columbia. The filing was accompanied by a Press Release, issued by her personal attorney and not the CFPB.

- The Bureau’s General Counsel – a Cordray appointee – issued a memo to CFPB staff on November 26th supporting Mr. Mulvaney’s assumption of the Acting Directorship.

- White House Press Secretary Sarah Sanders issued a Statement early Monday, November 27th stating: “The administration is aware of the suit filed this evening by Deputy Director English. However, the law is clear: Director Mulvaney is the Acting Director of the CFPB. Now that the CFPB’s own General Counsel – who was hired under Richard Cordray – has notified the Bureau’s leadership that she agrees with the Administration’s and DOJ’s reading of the law, there should be no question that Director Mulvaney is the Acting Director. It is unfortunate that Mr. Cordray decided to put his political ambition above the interests of consumers with this stunt.”

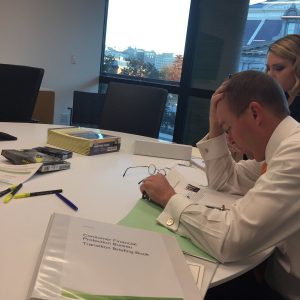

- With no TRO yet in place, Mr. Mulvaney showed up for work the morning of Monday, November 27, and was photographed at the Director’s desk with a “Consumer Financial Protection Bureau Transition Briefing Book” in the foreground. (Is it me, or does he seem to be suffering from a headache?)

A Tragedy or a Comedy?

Let me quote from the classic comedy team, Laurel & Hardy: “Here’s another nice mess you’ve gotten us into!” Indeed, because of his “going out the door,” last-second, appointment of an Acting Director, former CFPB Director Richard Cordray has created quite a mess. His actions have incited a potential civil war within the agency, and between a federal agency and the President. We’ve experienced the incredible sight of two individuals claiming the same title, and one of those people suing the other one and the President. As today (November 27th) dawned, these questions went through my mind: Are Mulvaney and English going to fight over the keys to office? Who will staff listen to? What about security or law enforcement? What if the two Acting Directors send conflicting notices to be published in the Federal Register? Who will control the Bureau’s social media accounts? Who will the Webmaster listen to? Monty Python also would have loved this.

Ultimate Winners … and Losers

In the end, the President will win when his nominee for the Director post is confirmed by the Senate. In the meantime, I suspect Mr. Cordray has unwittingly confirmed perceptions that the Bureau is a rogue agency. I also think his actions will galvanize the Republican Senate majority to brush aside Democrat objections and swiftly confirm the President’s nominee for the full Directorship. Moreover, it wouldn’t surprise me if legislative efforts to reform the CFPB to require much greater accountability – or even dismantle it – gain traction. If that was Mr. Cordray’s plan and his desired legacy, he has in my opinion executed his plan quite well.

What of Consumer Arbitration Reform?

The pity of all this is that reform of consumer financial arbitration – in my opinion a worthwhile endeavor – has been set back if not killed. As described in my recent ARS blog post, Let’s Not Toss Out the Data-gathering Baby with the CFPB Arbitration Rule Bathwater, the now-defunct CFPB arbitration rule would have required that regulated financial institutions file customer claims and awards data with the CFPB, which the Bureau intended to publish in redacted form starting July 2019. I said in my blog, this part of the arbitration rule is now gone, and one wonders whether the Bureau can promulgate a new proposed Reg that addresses only the arbitration record and data requirements? I’m afraid this is now impossible, and in my opinion, it’s a sad byproduct of Mr. Cordray’s recent actions.

__________________

*George H. Friedman, Chairman of the Board of Directors of Arbitration Resolution Services, Inc. and an ADR consultant, retired in 2013 as FINRA’s Executive Vice President and Director of Arbitration, a position he held from 1998. In his extensive career, he previously held a variety of positions of responsibility at the American Arbitration Association, most recently as Senior Vice President from 1994 to 1998. He is an Adjunct Professor of Law at Fordham Law School. Mr. Friedman serves on the Board of Editors and is a Contributing Legal Editor of the Securities Arbitration Commentator. He is also a member of the AAA’s national roster of arbitrators. He holds a B.A. from Queens College, a J.D. from Rutgers Law School, and is a Certified Regulatory and Compliance Professional.