On the last day for SEC review of FINRA’s latest proposal for improving the expungement process, the Authority temporarily withdraws the rule filing.

Just one issue ago, we provided an extensive review of this long-running rule proposal — SR-FINRA-2020-030 — which has its origins in the Dispute Resolution Task Force and its Final Report and Recommendations. We won’t repeat here our exhaustive review, but we encourage readers and followers to peruse the lead Squib in SAA 2021-20 (May 27), PIABA and the PIABA Foundation: Expungement Process is Still Flawed.

The Original Rule Proposal

As discussed in SAAs 2020-37 (Oct. 7) & -36 (Sep. 23): “The proposed change, which incorporated comments and suggestions received on Regulatory Notice 17-42 (Feb. 5, 2008), was to amend the Codes to: “(1) impose requirements on expungement requests (a) filed during an investment-related, customer initiated arbitration (‘customer arbitration’) by an associated person, or by a party to the customer arbitration on-behalf-of an associated person (‘on-behalf-of request’), or (b) filed by an associated person separate from a customer arbitration (‘straight-in request’); (2) establish a roster of arbitrators with enhanced training and experience from which a three-person panel would be randomly selected to decide straight-in requests; (3) establish procedural requirements for expungement hearings; and (4) codify and update the best practices of the Notice to Arbitrators and Parties on Expanded Expungement Guidance (Guidance) that arbitrators and parties must follow. In addition, the proposed rule change would amend the Customer Code to specify procedures for requesting expungement of customer dispute information arising from simplified arbitrations. The proposed rule change would also amend the Codes to establish requirements for notifying state securities regulators and customers of expungement requests” (footnote omitted).

Recent History: PIABA Says Process is Still Flawed

Noting that the SEC had until May 28 to act on FINRA’s latest rule change proposal, PIABA and the PIABA Foundation on May 18 issued REPORT: 2021 Updated Study on FINRA Expungements. It was announced in a Press Release, PIABA Foundation/PIABA: New FINRA Steps to Fix Flaws in Brokers Misconduct “Expungement” Process Won’t Work, Independent Investor Advocate Needed, and introduced in 50-minute Press Conference. The latest study – PIABA’s third on the subject – examined 700 expungements from August 2019 to October 2020. We provided the key points in #20.

FINRA Posts a “Temporary Withdrawal”

May 28 brought a Press Release, FINRA Statement on Temporary Withdrawal of Specialized Arbitrator Roster Rule Filing, announcing: “Following consultations with the SEC staff, we temporarily withdrew from SEC consideration our rule filing establishing specialized arbitration panels for expungement requests so that we can further consider whether modifications to the filing are appropriate.” The two-page regulatory filing provides no further insights. As for what’s next, FINRA states that it: “remains committed to working with the SEC and other stakeholders who share a common interest in revising the process for reviewing the information on a broker’s record in the Central Record Depository (CRD®).”

New Webpage on Expungement

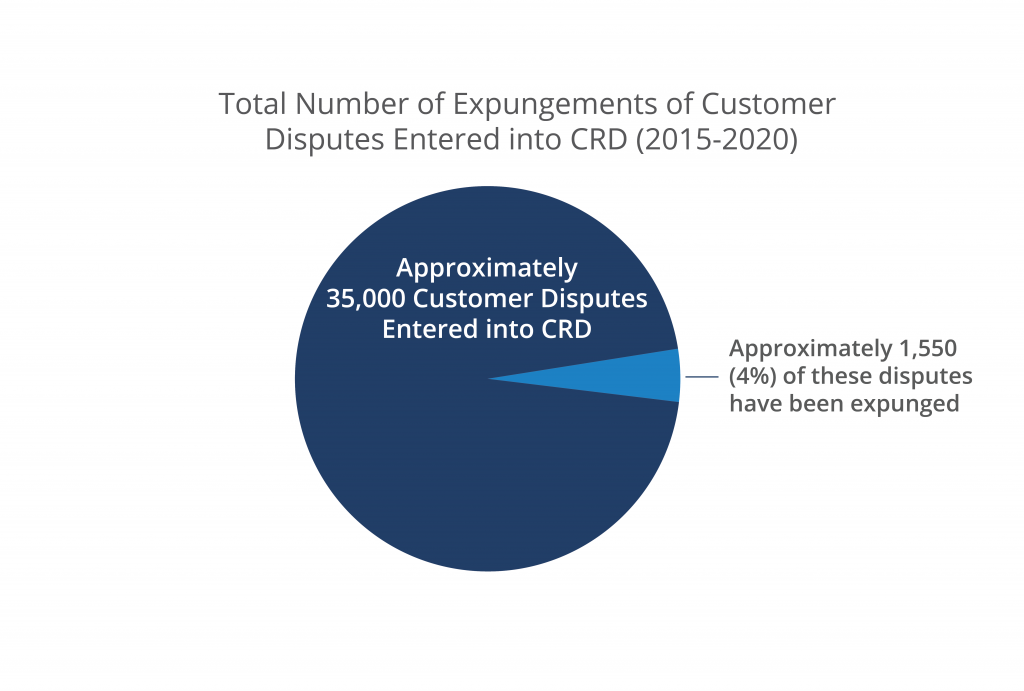

Included in the Release is a link to a new dedicated Webpage, Expungement of Customer Dispute Information, that provides an exhaustive review of the contentious expungement issue. This link and chart-rich page has these main sections: How it Works; Recent Key Rule Filings; and Expungement Initiatives Chronology. The page offers refutations of past criticisms, or puts them in perspective. For example, one graphic below shows that: “Of the approximately 35,000 customer dispute information disclosures in the CRD system entered between 2015-2020, approximately 1,550 or 4% have been expunged pursuant to a court order as of May 25, 2021.”

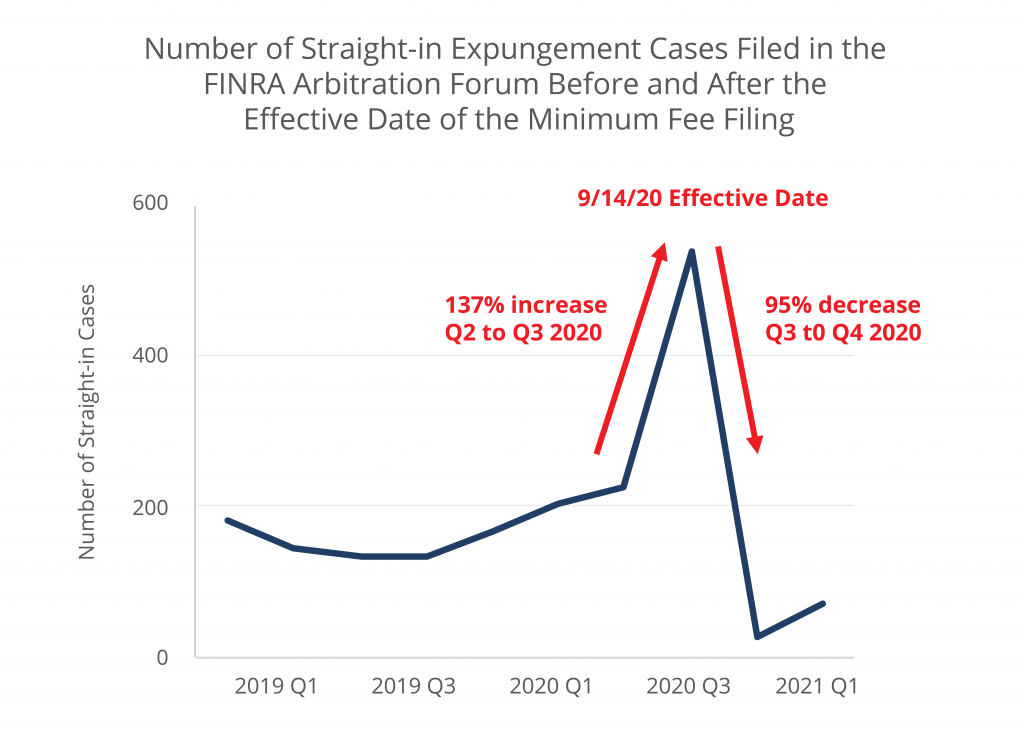

Another chart demonstrates that expungement requests plummeted after the September 14, 2020 effective date of a rule change amending the Codes: “to apply minimum fees to requests for expungement of customer dispute information, whether the request is made as part of the customer arbitration or the broker files an expungement request in a separate arbitration (straight-in request).”

(Source: FINRA. Both charts published with FINRA’s permission, and bear a legend noting: “*FINRA is working to provide additional data and analysis regarding expungements.”

What’s Next?

FINRA will keep working with constituent groups to improve the proposal, which we imagine will include PIABA, NASAA, and SIFMA, and then go back to the NAMC, FINRA Board, and SEC. The “temporary” nature of the withdrawal is a clear signal to us that in some iteration, this proposal will be back. Such an approach is not unprecedented. In 2008 FINRA withdrew its 2005 explained award rule filing, and ultimately replaced it with current Rule 12904(g). See our blog post, Explained Arbitration Awards and Goldilocks and the Three Bears – Is the Third Try Just Right? (June 9, 2016).

(ed: *We said in #20: “Where this leads remains to be seen.” Now, we know. **We see this as evidence that the 19b process worked: the rule was filed and published; comments from a wide swath of constituents pointed out areas needing improvement; and FINRA pulled back to regroup and consider changes. ***As our publisher and Editor-in-Chief said recently: ““This is a monumentally important rule, so going back to the drawing board was a better option. Better right than rushed.”)

This post first appeared on the Securities Arbitration Alert blog. The blog’s editor-in-chief is George H. Friedman, Chairman of the Board of Directors for Arbitartion Resolution Services, Inc.