By George H. Friedman, ARS Chairman of the Board and SAA Editor-in-Chief

and Richard P. Ryder, SAC Founder and President

This blog post is adapted from one that ran in the Securities Arbitration Commentator blog on March 2, 2020. Republished here with thanks to SAC.

The crashing capital markets in the wake of the worldwide Coronavirus outbreak causes the Alert’s George H. Friedman and Rick Ryder to reflect on what this might mean for FINRA’s arbitration caseload. It wasn’t that hard; dusting off and updating a 2015 blog post was all that was needed.

We debated whether to lead with a Yogi Berra quote, “It’s like déjà-vu, all over again,” or with Shakespeare’s quote from The Tempest. We decided to go with both. Following recent capital market gyrations and volatility, the focus sooner or later turns to what these events mean for securities arbitration case filings and the participants. Having been involved in the financial services and ADR worlds for more years than we care to remember, and having seen this movie a few times before, we offer our thoughts on what recent market activity, especially the precipitous drops and rapid recoveries (ed: as we went to press, the Dow had recovered more than 1,300 points in less than three trading hours) might mean for FINRA’s arbitration filings.

Arbitration Filings Run Countercyclical to Market Performance

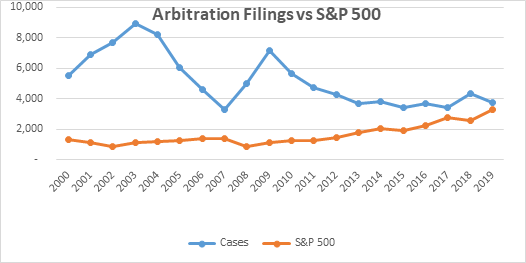

FINRA’s arbitration case filings tend to run countercyclical to the capital markets. So it is not surprising that, with the markets enjoying a robust 2011-19, FINRA Dispute Resolution’s arbitration case filings plummeted to 3,757 cases by the end of 2019 – nearly halving the post-crash high of 7,137 cases filed in 2009. In fact, 2019’s filings would have been even lower, but for the surge in “under the wire” cases due to the Puerto Rico bond fund mess. The chart below shows the number of arbitrations filed at FINRA each year, compared with the S&P 500’s close at the end of the year. The trend lines are unmistakable: When the markets perform well, arbitration filings decline. When there are prolonged, significant market declines, the case filings surge as surely as the swallows return to Capistrano.

People Don’t Fight So Much When Times are Good

Why is this the case? Simply put, people fight less when they are making money, and they fight more when they are losing money. And already, there are media reports of concerns about investor backlashes. For perspective, harken back to the 1987-1988 arbitration case filing surge at the SROs. It was the October 1987 “Black Monday Crash” plus the Supreme Court’s OK of securities predispute arbitration agreements in Shearson/American Express, Inc. v. McMahon, 482 U.S. 220 (1987), that drove that big escalation in claims filed. Three years following the 2000 “Tech Wreck,” FINRA arbitration case filings peaked at 8,945. Then the markets recovered, and arbitration case filings plummeted through the beginning of 2008. Next, the Great Recession hit, the markets tanked and arbitration filings more than doubled. Finally, the recent bull market followed, and arbitrations dwindled from about 7,000 to current levels.

More Arbitration Filings Ahead?

What does the past tell us? The significant and rapid decline in the markets in recent days will likely lead to arbitration filings going up significantly. The markets’ retreat has certainly produced enough losses; news reports say that investors have lost more than $3 trillion by the end of February, but will the decline be sustained? That, only time will tell. If so, then the past as prologue suggests arbitration filings could go up 50-75%, perhaps more. Why do we say “perhaps more”? Besides general market conditions impacting arbitration filings, discrete product failures will surely augment filings. It has happened in the past (think: auction rate securities and subprime collateralized debt obligations), it’s still happening now (Puerto Rico bond funds), and it will surely happen in the future (we just don’t know the product yet).

What Kinds of Cases?

What issues will the next surge in arbitrations feature? We’re not market prognosticators and it’s too early to say what the fallout will be from the recent “Coronavirus Crash” in terms of claims, but our short answer is: to predict the future, look to the past. Here’s our current thinking (the parenthetical is a pithy summary of each side’s position):

Suitability: These customer claims tend to rise after significant market declines (“My investment strategy was preservation of capital; why did you have me in these risky, unsuitable investments?”). The firms tend to offer ratification defenses (“Odd that you got statements every month and never complained when you were making money”).

Execution – technical: Here, the customer complains about not being able to reach their broker by phone or online during rapid market declines (“I called and called trying to sell and could not get through. And your online trading platform was useless.”). Firms tend to say that the investor’s experience was not unusual given market conditions (“Our performance was not unusual given market conditions at that time”). Think of the technical glitches when Facebook went public in 2012.

Execution – general: These customer claims often involve stop-loss orders, with the investor complaining that their stock was sold at a much lower price than they anticipated. Suppose, for example, the investor has a stop-loss order for XYZ stock at $100. In a rapidly declining market, the trade finally ends up being executed at $90 a share. The investor contends that the broker cost them $10 a share (“What part about $100 was unclear?”). The broker’s defense is that the trade was executed in a timely manner given market conditions (“XYZ’s price was dropping like a stone, and it was not that easy quickly matching buyers and sellers under those conditions. And, our performance was consistent with peers”).

Overconcentration: The cases tend to be associated with sector or individual stock declines. The customer doesn’t necessarily raise suitability issues but instead contends their account was overconcentrated (“Why was I so concentrated in travel and leisure stocks? Or emerging market-China ETFs? Or, I’m not saying bonds and bond funds were unsuitable investments, but why was Grandpa so heavily invested in airline bonds?”). Again, the firms usually defend with a ratification defense.

Margin – general: Arbitration claims generally rely upon realized losses. If investors hold through a downturn and the market quickly recovers, potential losses evaporate. Margin trading increases the chances of realized losses in market declines, because that’s when margin calls test investors’ resolve (and financial wherewithal). In our 2015 blog post, we quoted FINRA reports tagging total debit balances in customer accounts at $485.9 million at the end of January 2015. FINRA posts margin statistics on its Website (ed: this is a great resource, and it lags less than in the past). Margin debt, we know from past SAA reports, have surpassed the half-trillion mark before (four months in 2014), but, by January 2015, debit balances in customers’ securities margin accounts had subsided to $485.9 billion. That number hit a high of $668.9 billion in May 2018, during a time when the Dow Jones rose from about 18,000 to 24,000. A four-month, 9% downdraft from September to December 2018 shaved $100 billion off that high. During 2019, the Dow climbed fairly steadily — almost 5,000 points — closing above 28,000 at the end of the year, but margin debt rose only about 5% year-over-year to $579 billion. Interestingly, in 2020, while the market continued to rise for a month and a half more, debit balances in aggregate started a slide in January and we expect the margin statistics in February to reflect a substantial consolidation.

Margin – investor claims: When the capital markets drop precipitously and then quickly rebound, margin customers may be sold out near the bottom, only to see the stock’s price come all the way back a short time later (“You [terrible, awful, evil, bad person]! You gave me a margin call when I was taking a lunch break, and sold me out 10 minutes later”). This is exemplified in the extreme by the 36-minute long “Flash Crash” of May 6, 2010… or that of 2015. The firms will point out that they really didn’t have to give any notice and their actions were consistent with the account agreement and FINRA rules (“We gave you 10 minutes when we really could have given no notice”). Firms will also point out that, had they waited any longer, the losses would have been worse, possibly resulting in a margin deficit. Arbitrators often look to past practice.

Margin – brokerage firm claims: When the markets suffer significant drops and don’t recover, customers may end up with margin deficits. In other words, even taking into account the stocks sold off, the investor still has a negative margin balance (“So, after deducting the stocks we sold off to address your margin deficiency, you still have a debit balance of $50,000”). Customers don’t react well to this (“You [terrible, awful, evil, bad person]! You gave me a margin call when I was in the bathroom, and sold me out 10 minutes later. Go [engage in a physically impossible act]!”).

Employment: If there’s a prolonged bear market, look for employment cases, especially promissory note cases, to increase. This happened after the bear market that started fall 2008, as firms contracted, merged, or simply went out of business.

Other? Besides margin calls, some of the other likely culprits may be players getting whip-sawed by the VIX and option strategies (short puts especially, but long calls as well) that presumed a continued up market.

And of Course there will be Frauds and Scams

It seems that, when there are natural disasters and health crises, scams targeted at investors follow shortly thereafter. So it comes as no surprise that, on the heels of the Coronavirus outbreak, the SEC’s Office of Investor Education and Advocacy issued an Investor Alert warning of scams arising out of this health crisis. The February 4, 2020 Investor Alert, titled Look Out for Coronavirus-Related Investment Scams, warns: “Fraudsters often use the latest news developments to lure investors into scams. We have become aware of a number of Internet promotions, including on social media, claiming that the products or services of publicly-traded companies can prevent, detect, or cure coronavirus, and that the stock of these companies will dramatically increase in value as a result. The promotions often take the form of so-called ‘research reports’ and make predictions of a specific ‘target price.’ We urge investors to be wary of these promotions, and to be aware of the substantial potential for fraud at this time” (emphasis in original).

Time for Another Look at Online ADR?

Absent an effective vaccination or treatment, we expect that as time goes by there will be growing resistance from arbitration participants to physically assemble for a hearing. ADR providers may also have similar qualms. To us, this portends increasing interest in and usage of online ADR.[1] It’s not a huge leap to envision FINRA reacting to growing contagion by temporarily halting cases and requiring hearings to be conducted by teleconference or video. Again turning to the past to see the future, we recall that FINRA in September 2017 posted on its Website, Hurricane Maria Update: Accommodations for Hearings Scheduled in Puerto Rico. Said the Notice:

“FINRA Office of Dispute Resolution has continued to monitor the situation in Puerto Rico and based upon the latest information available, is administratively staying all cases venued in Puerto Rico until October 20, 2017. This includes canceling all hearings, conference calls and deadlines scheduled during this time. FINRA will begin the process of rescheduling any impacted hearings and pre-hearings as soon as reasonably practicable, once the stay is lifted.”

This reminded us of when NASD Dispute Resolution took a similar approach to New York-area cases in the wake of 9-11. In that instance, the agency temporarily postponed and stayed hearings in that region, relying on then-Rule 10308(e), which provided: “The Director may exercise discretionary authority and make any decision that is consistent with the purposes of this Rule and the Rule 10000 Series to facilitate the appointment of arbitration panels and the resolution of arbitration disputes.” If FINRA was comfortable temporarily postponing case administration and hearings in response to regional emergencies, we suggest it would consider requiring hearings to temporarily be conducted by electronic means in response to a global pandemic. It’s already happening; China in late January began to require trials to be conducted by videoconference,

Conclusion

We hope and pray the virus is contained, the markets recover, and that our major concern in the near future is arbitration processing times. As that great baseball philosopher Yogi Berra said, “It’s tough to make predictions, especially about the future.” We can compare notes in a year.

(ed: *Interestingly, we haven’t seen that much from the SEC or FINRA warning BDs to check their margin policies, etc. — not like back in the earlier 2000s where the regulators and consequently the BDs were on top of the market break in terms of margin control. **We’ll be keeping an eye on the “Margin Calls” Controversy Type on FINRA’s monthly report — the figure is modest, but has been up the last few years (85, 79 and 58, respectively). **Already, there is media speculation that margin debt will rise because of virus-related market volatility.)

Like what you see here?

Twice a week we present blog posts consisting of one write-up from each of our two flagship weekly online Alert services, the Securities Arbitration Alert and the Securities Litigation Alert. Consider a subscription to these publications receive the full array of coverage right on your desktop every week.